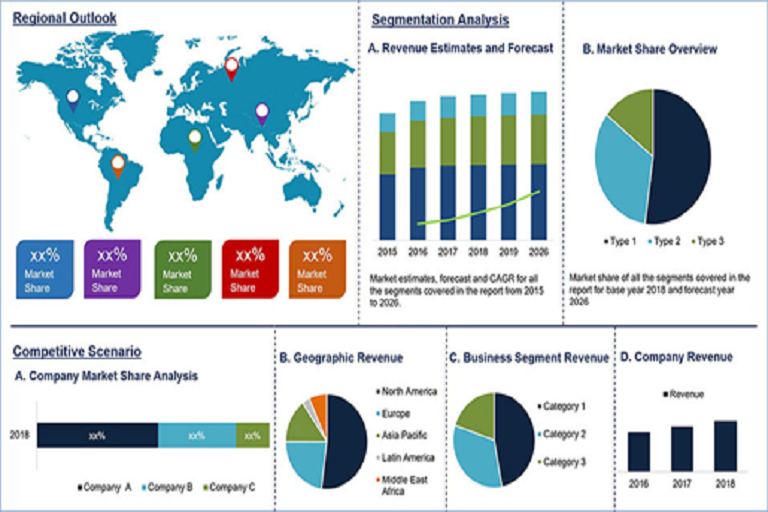

According to a new study published by Polaris Market, the global Electronic Contract Manufacturing Services market is anticipated to reach USD 554.2 billion by 2026. With the rising competition in the electronics industry, increasing cost reduction pressure on OEMs, complexity of electronic products, and decreased product lifecycles, the demand Electronic Contract Manufacturing Services market has boosted globally.

For attaining this, OEMs are seeking support from electronic contract manufacturing companies. These OEMs (hirer) subcontract electronic manufacturing contract companies to take advantage from their design expertise, supply chain management, and manufacturing capabilities. This helps the OEMs to leverage resources, reduce costs, access prominent manufacturing technologies, as well as reduce fixed capital investments and fulfil the Electronic Contract Manufacturing Services market demand.

In addition to this, electronic contract manufacturing also helps in retaining in-house activities and control responsibilities including, quality assurance, product cost management, network solutions integration, customer service, order management, customer interactions, and introduction of new products. These factors are highly responsible for propelling the Electronic Contract Manufacturing Services market growth for electronic contract manufacturing services during the forecast period.

The design & engineering segment is expected to notice a high growth during the projected period attributed to increasing preference of OEMs for subcontracting their design requirements. Also, the global market is observing an increase in growth, with the surging demand for electronic circuit boards attributed to its rising significance in several electronic devices including, smart phones and tablets. Several OEMs are subcontracting their circuit assembly requirements to contract manufacturers, resulting in significant increase in their profit margins.

The market operates in a highly competitive environment particularly, the players located in Taiwan and China are providing very economical subcontracted services for manufacturing. The current major focus of these vendors is to support and promote green technologies in their manufacturing processes. Another trend noticed in the current market scenario is increase in acquisitions, mergers and partnership activities. Moreover, the Electronic Contract Manufacturing Services market growth in the North American region is propelled by automotive as well as medical industries. Several R&D centers as well as healthcare institutes in North America are focused on the development of innovative diagnostic products that they plan to outsourcing from contract manufacturers. Such factors are expected to boost the market in the region.

The major players operating in the electronic contract manufacturing services market include Flextronics International Ltd, Hon Hai Precision Industry (Foxconn), Universal Scientific Industrial Co Ltd, Shenzhen Kaifa Technology, Beyonics Technology, New Kinpo Group, Benchmark Electronics, Sanmina-SCI, Zollner Elektronik, Celestica, Jabil, Inc., and Elcoteq SE among others.

Have Questions? Request a sample or make an Inquiry Please clicking the link below:

Electronic Contract Manufacturing Services Market Size and Forecast by Type

Key findings

System Assembly Manufacturers

PCB Assembly Manufacturers

Design & Build Manufacturers

Electronic Contract Manufacturing Services Market Size and Forecast by Application

Key findings

Consumer Electronics

Electronic Components

Computers & Peripherals

Industrial Electronics

Others

Electronic Contract Manufacturing Services Market Size and Forecast by Regions

Key findings

North America

US.

Canada

Europe

Germany

UK

France

Italy

Asia Pacific

China

South Korea

Japan

India

Latin America

Brazil

Mexico

Middle East & Africa