Technology-focused buyout firm Francisco Partners said it agreed to acquireHealthcareSource HR Inc ., a provider of human-resources software, from Insight Venture Partners .

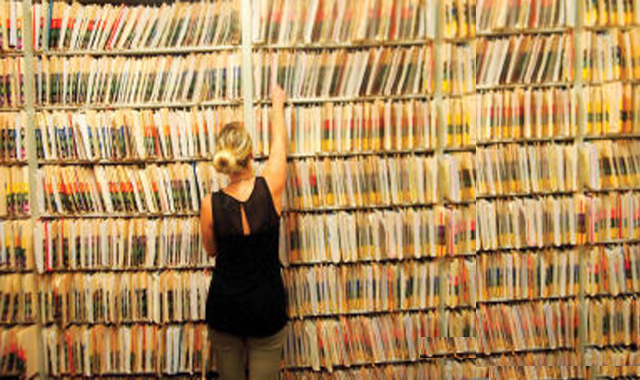

The Woburn, Mass., company provides cloud-based talent management software for the health-care industry, helping facilities with the recruitment, retention and training of health-care professionals.

“Health care employs over 12 million Americans and is one of the fastest-growing employment markets in the country,” said Ezra Perlman , a co-president at Francisco. “It is very challenging for hospitals and health-care systems to figure out how to hire the right people effectively and efficiently, how to retain those people over time and how to train them as effectively as possible.”

The U.S. Bureau of Labor Statistics said in 2013 that it expected occupations and industries related to health care and social assistance to increase at an annual rate of 2.6%, adding 5 million jobs between 2012 and 2022 .

HealthcareSource serves more than 2,500 health-care clients, according to the company’s website. Mr. Perlman said its customers are primarily hospitals and post-acute care facilities that look set to benefit from the increased demand for care from the nation’s aging population.

“But even for the hospital market, which is growing more slowly than the post-acute market, there are still a lot of potentials and opportunities for HealthcareSource because of the value their solutions bring,” he said.

Terms of the transaction, expected to close within about 30 days, weren’t disclosed in a news release. Francisco pursues investments with transaction values of $50 million to more than $2 billion.

New York-based Insight invested in HealthcareSource in 2008. The company since has expanded organically and through add-on deals. HealthcareSource acquired continuing nursing education approved courses from Bluedrop Learning Networks last year, and bought NetLearning software products from academic publishing company Cengage Learning Inc. in 2012.

Francisco has invested in the field before, backing Hartford, Wis.-based API Healthcare Corp ., a health-care workforce management services provider the San Francisco firm sold to General Electric Co . early last year.

Unlike HealthcareSource, which manages workers on the recruitment front, API’s software manages the scheduling, flow and availability of staff, patients and assets to help hospitals realize productivity gains.

Francisco in November also invested in another health-care technology company,CoverMyMeds LLC , out of its $2 billion third fund, Francisco Partners III LP. CoverMyMeds’ software automates the medication benefit process in a bid to reduce administrative waste.

“Health-care technology is a very important sector for us,” Mr. Perlman said. “Over the last decade, it has been one of our most significant investment priorities.”

The HealthcareSource investment comes after Francisco, closed its fourth fund at $2.88 billion earlier this year.

Investment bank William Blair & Co . and law firm Willkie Farr & Gallagher LLPadvised HealthcareSource on the deal.