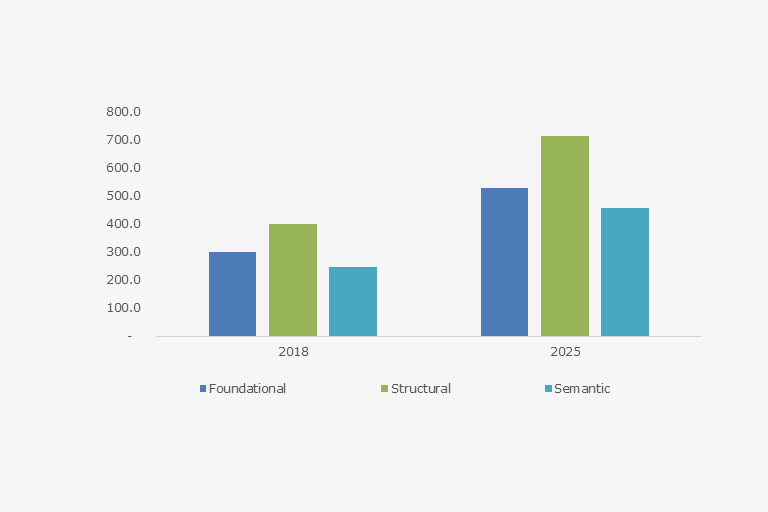

U.S. Healthcare Data Interoperability Market Size, By Level, 2018 & 2025 (USD Million)

Healthcare Data Interoperability Market size is set to exceed USD 3.5 billion by 2025; according to a new research report by Global Market Insights.

Increasing technological advancements in healthcare data interoperability software will positively influence industry growth in coming years. Key industry players such as Allscripts and Orion Health undertake several efforts to integrate innovation in interoperability software utilized by healthcare facilities. Recently developed healthcare data exchange software are highly efficient and improve the data transfer process. Important patient and other clinical data can be transferred securely through technologically advanced interoperability software. This scenario proves beneficial for the industry growth as it increases the demand for healthcare data interoperability software.

Rising government initiatives in North America and other developed regions will surge the industry growth in forthcoming years. Government annually spends stupendous amount on promoting development in healthcare software that enables efficient data management. Such initiatives increase availability of technologically upgraded data interoperability software that facilitate data exchange process. However, high price of the medical data interoperability software will restrain the industry growth to some extent.

Get a Sample Copy of this Report @ https://www.gminsights.com/request-sample/detail/3148

Semantic segment is anticipated to witness over 9.5% growth throughout the forecast period. Semantic interoperability enables healthcare professionals to exchange, interpret and use clinical information to provide proper treatment. It structures the data that makes it easy for doctors to analyze information accurately. Moreover, semantic level of interoperability supports secured electronic exchange of patient’s information amongst hospitals, diagnostic centers, pharmacists and also proves to be a cost-effective option. Thus, benefits offered by this segment will increase the demand and drive the segmental growth.

Cloud-based segment had around 64% revenue share in 2018 and is anticipated to grow significantly over the forthcoming years. Cloud-based interoperability software have numerous advantages over on-premise software. On-premise software enables only transfer of information among different departments of single healthcare institution, whereas cloud-based software enables exchange of data globally without interruptions. This results in easy flow of information. Thus, doctors, pharmacies and diagnostic labs have high preference for cloud based software that escalates business growth.

Diagnosis segment was valued around USD 1 billion in 2018, owing to increasing importance of early diagnosis of chronic diseases. Diagnostic data needs to be transferred from laboratories to hospitals for further treatment. In process of sharing information, data leaks may occur that have hazardous repercussions. Thus, diagnostic laboratories adopt reliable interoperability software extensively that allows digital exchange of information.

Centralized model segment is estimated to experience 9% growth throughout analysis time period. Centralized model has maximum flexibility and can exchange information over several platforms. This software respond to data request quickly due to availability of central repositories. This helps doctors and physicians to get access to patient’s whole history in lesser time. Thus, doctors can provide efficient treatment that enhances the patient outcomes. Aforementioned factors are projected to drive segment growth.

Hospital segment was valued at USD 1 billion in 2018. Hospitals have huge patient data that is difficult to manage. Healthcare data interoperability solutions aid hospital to share data within departments and even with pharmacies. Quick and efficient data transfer enables doctors to provide well-organized service in less time that proves beneficial for segmental growth.

North America healthcare data interoperability market will witness 8.8% CAGR over the forecast timeline. Substantial growth is attributed to high adoption rate of technological upgraded software. Benefits offered by healthcare data interoperability enables simplified analysis of gathered clinical data that helps doctors to provide accurate diagnosis. Furthermore, the U.S. government is encouraging healthcare industry by spending abundant money to develop new technologies. As a result, leading industry players are taking efforts to develop innovative healthcare interoperability software that will positively impact the regional market growth.

Notable industry players operational in healthcare data interoperability market are Epic, Orion Health, Medicity, Optum Insights, Allscripts, Philips, Oracle, Cerner Corporation, Smith Medical, Ciox Health, Teletracking Technologies, Edifecs Inc and Experian Health. These key players have adopted numerous strategic initiatives such as new product launch and acquisitions to acquire prominent market share. For instance, in December 2017,Philips acquired Forcare. This acquisition will expand Philip’s interoperability software portfolio.

Source: https://www.gminsights.com/industry-analysis/healthcare-data-interoperability-market