$11 Billion Windfall: DoD Deal An Epic Gamechanger?

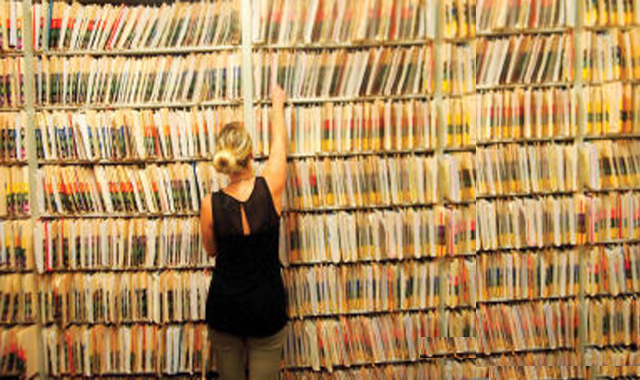

Communication is key in any health-care setting, but for the U.S. military’s health-care leaders it is becoming job No. That’s because the military’s vast legacy health-care system has fallen short in its goal of serving over 10 million patients across 412 medical clinics and 65 military hospitals.

As a result, the Department of Defense is launching a massive modernization plan to replace its existing electronic health records system. The contract could be worth $11 billion to the winning bidder, making it a potential revenue game changer for a host of EHR software providers.

Cerner (NASDAQ: CERN ) , Allscripts (NASDAQ: MDRX ) , and athenahealth (NASDAQ: ATHN ) are all expected to compete for the business, but they may have a hard time outmaneuvering a recently announced partnership between IBM (NYSE: IBM ) and privately held Epic Systems, the nation’s largest EHR provider.

Source: Department of Defense Flickr.

Out with the old, in with the new

The Pentagon has struggled to enable its current EHR system communicate with the Department of Veterans Affairs and private EHR systems, but that effort has come up short.

Following the failed launch of the administration’s Government.com health system, the pressure is high on the DOD to award the contract right the first time. That has the Pentagon considering options and inviting corporate EHR leaders to the table to discuss what the system will need to do today and years from now.

One company that will be at that table is Allscripts, which has a roughly 10% market share that makes it one of the largest EHR providers. Winning the contract would make a significant impact on Allscripts given that the company’s annualized sales run at about $1.2 billion for 2014.

It would similarly be a windfall for athenahealth, a small cloud-based EHR company that has made a splash in providing records, practice management, and relationship management software to smaller health-care providers. Athenahealth’s sales grew 41% to nearly $600 million in 2013, but it commands just 3% market share in EHR, according to research firm KLAS.

Cerner may be less of a long shot given that it’s the second-largest provider of EHR systems for hospital systems and other large health-care providers in the U.S. and a top-five systems provider worldwide. Despite its leadership position, the military contract would still be a big boon for the company given that sales totaled a little less than $3 billion in 2013, up 9% from 2012.

However, IBM and Epic may be best positioned to win the contract to connect the military’s system with public and private health care providers and prevent unauthorized access to patient data.

Epic is the market share leader in the U.S. and the third-biggest player overseas. Its customers include more than 250 of the nation’s largest hospitals, and those large systems exchange more than 2 million records monthly with other vendor platforms, including the VA’s. Epic’s experience in deploying big, complex systems could give it an edge over smaller players such as athenahealth, which is led by former President George W. Bush’s cousin Jonathan Bush.

Meanwhile, IBM’s federal healthcare business is no rookie, either. IBM’s global information research and health-care segments already work closely with the government through contracts covering hardware, software, and security. Even as Big Blue teams up with Epic, it has also announced the launch of a federal government-specific cloud infrastructure consisting of two data centers designed for high speed data transfer. Those data centers, which could conceivably help deliver cloud-based EHR services someday, will initially have 30,000 servers supporting 2,000 gigabytes per second of connectivity. Given that IBM systems already handle 90% of the globe’s credit card transactions, and half of the Fortune 100 are clients, IBM knows a thing or two about large scale security that could be valued highly by the DOD.

Fool-worthy final thoughts

The $11 billion contract for replacing the military’s aging health-care records system is truly mammoth in size, scope, and potential impact on industry revenue. To put the contract in perspective, Accenture estimates the total North American EHR market will be worth $10 billion in 2015.

That means the winner of this contract will see a significant benefit to its top line. While Allscripts, athenahealth, and Cerner could similarly team up with another large technology provider like Amazon.com Web Services, it would seem that a combination of the nation’s biggest EHR provider, Epic, and Goliath IBM positions them at the front of the pack.

If you think $11 billion is a lot of cash, wait until you hear about this huge small-cap opportunity!

This smart device –kept secret until now – could mark a new revolution in smart tech (with big implications for health care). It’s a gigantic market opportunity — ABI Research predicts 485 million of its type will be sold per year. To learn about the small-cap stock making this device possible – the stock that could mint millionaires left and right when its full market potential is realized – click here.