In recent times, the popularity of non-dairy milk among health-conscious people has been on a rise, which is likely to influence plant milk market growth significantly. Apparently, plant-based milks comprise much lesser sugar as compared to livestock milk, and in addition, are endowed with extra fiber, extra protein, and an additional amount of omega 3 fatty acids. Cow’s milk, the most common livestock milk consumed, contains a large amount of lactose, which though healthy, may lead to major digestive issues. In consequence, regular cow milk consumers have lately been giving preference to lactose-free milk, which will considerably boost plant milk industry share. The most vital factor associated with the increased popularity of plant-based milk is its production process, that is free of animal cruelty. Moreover, plants are less expensive to grow – plants such as hemp, flex, cashew, almond, and soy used to produce milk require less manpower, less maintenance, water, and space. Besides all those benefits, non-dairy milks provide hormones and antibiotic-free products, which has been helping health-conscious people maintain their diet preferences. The changing consumer lifestyles owing to the growing health concerns among people about diabetes and obesity are thus slated to enhance plant milk market size.

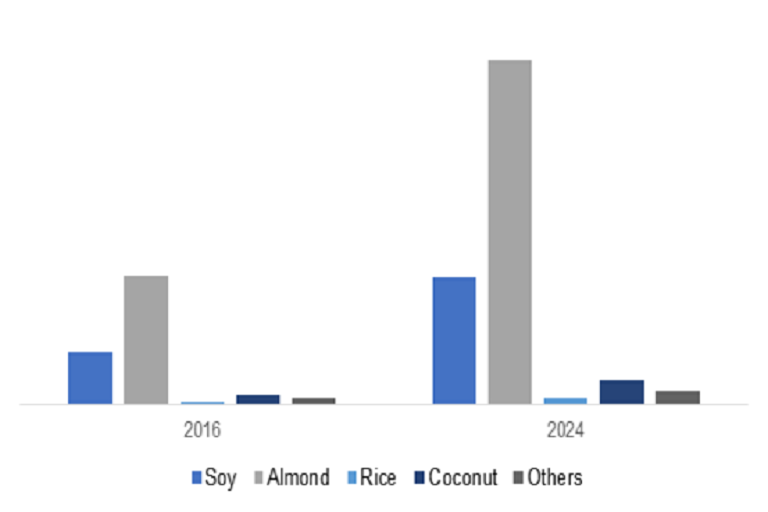

U.S. Plant Milk Market, By Source, 2016 & 2024 (Million Liter’s)

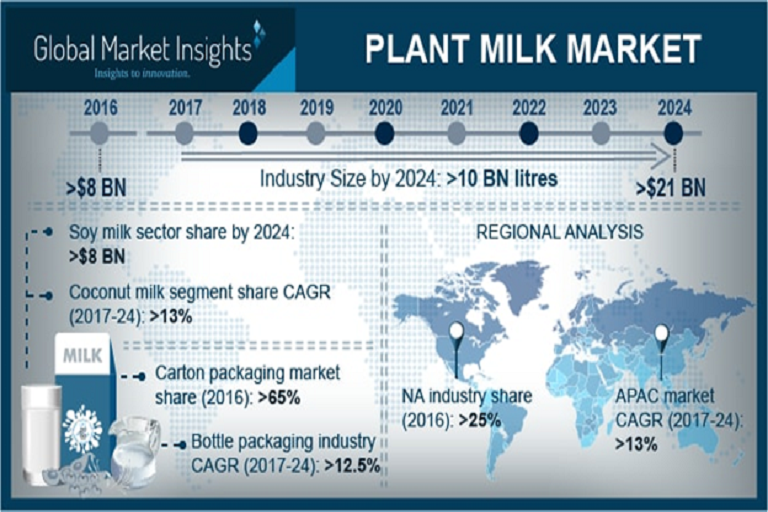

Considering the future scope of non-dairy milk, the renowned giants in plant milk industry are adopting growth strategies such as JVs and M&As. For instance, in 2016, the France-based company, Danone, acquired the U.S. based soy milk producer WhiteWave Foods for USD 10 billion. With this acquisition, Danone has been able to enhance its growth profile and reinforce flexibility across North America. In addition, it has improved its product portfolio through the strategic acquisitions of WhiteWave driven brands such as Wallaby Organic, Horizon Organic, and Silk, while consolidating its stance in North America plant milk industry. As per statistics, in 2016, North America covered around 25% of the global plant milk market share. Apart from North America, this acquisition has also implicated Europe plant milk industry share, pertaining to the post-merger approval of the European Commission for the acquisition of U.S. based foods giant, WhiteWave.

Get a Sample Copy of this Report:@ https://www.gminsights.com/request-sample/detail/2250

The ample availability of raw material required for making non-dairy milk is likely to stimulate plant milk market trends over the years ahead. The benefits of soy, rice, and almond based milk affecting plant milk industry share are described below:

Soy milk: It is one of the most preferred milks for toddlers, given that they usually are incapable of digesting milk sugar. Soy milk is also an excellent source of fiber, protein, minerals, fatty acid, and vitamins, on the grounds of which it is being widely consumed. This in consequence, would have a considerable impact on soy-based plant milk market size, slated to generate more than USD 8 billion by the end of 2024.

Almond milk: Almond milk is rich in omega 3 fatty acids, minerals, and vitamin E, has low sodium content, and 50% more calcium content than dairy milk. The low-calorie content may help obese people to reduce the cholesterol – thus the growing popularity of almond milk among heart-healthy people is slated to propel plant milk market share over the years ahead.

Currently, plant-based milks are emerging as viable alternatives for livestock milk across developing countries. In order to overcome the insufficient supply of animal milk, many of the players in plant milk market are investing heavily in food product developments. As technology intervention and the ongoing research efforts will ultimately help improve the quality of plant-based milk, its demand would observe a commendable rise globally, which would eventually impact plant milk market size, slated to cross USD 21 billion by 2024.

Increasing health issues owing to the use of bovine growth hormone into cattle to boost milk production has significantly hampered dairy industry. This has resulted in its ban from countries including Canada, the European Union, Australia, New Zealand, Japan, and Israel, hence fueling dairy alternative market. However, claims regarding hampered child growth due to use of dairy alternative product owing to lack of nutritional value compared to cow milk will restrain product adoption among young children.

Coconut will witness significant growth at over 13% up to 2024. Increased demand for coconut milk owing to the health benefits provided by coconut compared to soy will drive the product demand. Presence of significant amount of lauric acid in coconut, which when converted to monolaurin provides antiviral, antifungal and antibacterial properties. These properties in turn help in destroying wide variety of disease causing organism enhancing product penetration.

Mainstream stores accounted nearly 80% of the industry share in 2016. Growing disposable income and numerous value-added services offered by the modern retail outlets, substituting the conventional unorganized retailers is driving the product demand. Convenient locations, one-stop shopping, extended hours of operation, variety of merchandise, grab-and-go service and fast transactions are some of the key factors stimulating industry growth.

Unsweetened formulation will witness gains exceeding 12.5% up to 2024. Increasing demand for dairy alternative product made from plain milk including desserts, yogurt and cheese drives the demand for unsweetened plant milk formulation. Convenience regarding addition of preferred quality and amount of sweetener owing to various health concerns by individuals will further propel the product demand.

Carton packaging accounted for over 65% of plant milk market share in 2016. Increased innovation in production of varied range of carton packaging offering barrier from UV radiations, moisture and harmful gases & odor will stimulate industry growth of plant milk market. Eco- friendly and recyclable properties exhibited by carton packaging will fuel product demand.

Global industry share is highly fragmented owing to presence various local and international vendors. Some of the key players include Ripple Foods, Danone, Archer-Daniels-Midland, WhiteWave Foods, Califia Farms, Hain Celestial Group, Daiya Foods and Freedom Foods. Key players are capitalizing in innovation with new flavors and natural sweeteners to support stronger growth of the plant milk market.

Source : – https://www.gminsights.com/industry-analysis/plant-milk-market