Summary: Growing demand for wearable medical devices and high penetration of mobile phones around the globe are some of the factors that can be attributed to the increased demand for connected health and wellness devices.

The increasing focus on adoption of IoT devices and wearable medical devices, which includes sensors and mobile communication devices, is expected to drive growth of connected health in coming years. Rising adoption of technologically advanced personal health devices and penetration of smartphones & the internet around the globe can be attributed to the high demand for connected health & wellness devices.

Moreover, advancements in wireless networking and rise in demand for communication protocol standardization are creating requirements for IoT platforms that comprise sensors; actuators, which enable communication with other objects; machines; and environment. For instance, capsule endoscopes are small pill shaped micro cameras that are swallowed by a patient. They enter the intestine and relay images that help diagnose illnesses. In addition, vital sign monitoring sensors can provide early indications of chronic conditions. Statistics published in a white paper of Cognizant on July 2014 state that IoT is anticipated to have an economic impact of up to USD 2.5 trillion by 2025.

In addition, the associated benefits of connected health devices are as follows:

- Facilitate communication between caregivers, providers, and patients

- Continuous health monitoring

- Health record tracking

- Improve healthcare outcomes

- Regular, easy follow-up

- Enhance patient experience

- Better patient engagement solutions

Given below are some examples of clinical trials using connected health devices:

- The University of Pennsylvania started a clinical trial on November 2015, on hypertensive patients who have a history of cerebral infarction, to check whether social incentive would improve blood pressure readings at home. The study is estimated to be completed by January 2019.

- Johnson & Johnson used connected blood glucose meters with companion apps to check blood glucose levels in diabetic patients, which reduced A1C levels

- Philips Healthcare and the University of Leeds used in-home blood count devices and connected thermometers for monitoring chemotherapy patients

Digital technologies are being used in clinical trial procedures, enabling remote monitoring of patients and helping maintain timelines of trials. According to a report published by Grand View Research, the market for digital patient monitoring devices is expected to grow at the CAGR of 33.7% to reach USD 299.9 billion by 2025. The adoption of these devices is expected to increase due to growing inclination toward healthy lifestyle and fitness.

The major types of digital patient monitoring solutions are:

- Wireless sensor technology

- Wearable devices

- mHealth

- Telehealth

- Remote patient monitoring

The benefits associated with use of these solutions are expected to boost the market demand for connected health and wellness devices in the coming years. For example, use of wearable devices to monitor a patient’s health without admitting that patient into a hospital saves admission cost, mHealth apps are helpful in risk prevention, and telehealth services are useful for concluding on treatment options before a patient visits the healthcare provider.

Wireless Sensor Technology

In the healthcare sector, medical sensors are used as image sensors, pressure detectors, and temperature sensors for accurate monitoring, diagnosis, & treatment of a disease. In addition, these sensors have also rendered medical devices more effective and safe to use by simplifying their operation. The introduction of disposable biosensors has played a vital role in the evolution of medical sensors market. The disposable medical sensors are most commonly used by healthcare professionals and patients for easier detection of diseases. Industry participants are focused on developing and commercializing novel sensors to cater to the demand for disposable sensors by healthcare providers. For instance, Abbott received FDA approval for its FreeStyle Libre Pro system in September 2016. This is a Continuous Glucose Monitoring (CGM) system.

There has been a significant rise in number of pharma companies adopting sensor-enabled devices, such as inhalers, pill bottles, and syringes, to simplify their clinical trial procedures.

Some of the examples of clinical trials that utilize sensors are as follows:

- To track symptoms of Parkinson’s diseases and for monitoring physiological parameters, like limb movement, UCB uses a wearable sensor.

- To automatically record and collect patients usage data, GSK added sensors to inhalers

- Proteus Health’s ingestible sensor is embedded into a drug for bipolar & major depressive disorders as well as schizophrenia by Otsuka. This sensor works with a patch worn on the skin and enhances the customizability of medicines relative to the lifestyle choices and medication consumption pattern of patients.

Wearable Devices

The electronic devices that are light in weight, are smaller, and can be carried on one’s body are called wearable medical devices. Wearable medical devices offer round-the-clock monitoring of patients as many of these products can be worn for 24 hours without affecting routine life. Considering these distinct advantages, the demand for these products is anticipated to rise over the forecast period. The most common example of these devices are wrist-worn activity trackers, marketed by Fitbit, Garmin, and Jawbone. These type of wearables are less expensive than clinical-grade devices, as they are made for direct consumers. The consumer-grade wearables have sleeker, consumer-friendly designs and can be paired with apps that offer read-outs for the collected information. These benefits allow them to fit into the lives of clinical trial participants’, which is anticipated to result in their increased adoption in the coming years. R&D for creating wearables that enable monitoring and measuring of blood pressure & skin conductance is underway. According to a survey conducted by a consumer electronic organization in 2016, wearable fitness devices are expected to exhibit significant growth in the coming years, as these devices have become an integral part of the routine of their owners.

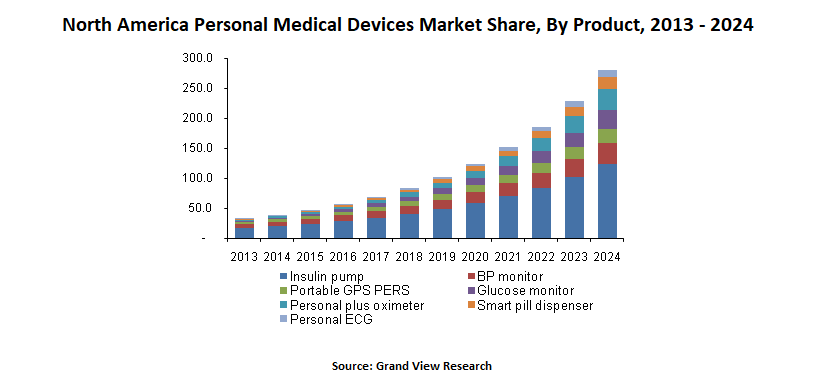

According to a Grand View Research report, the wearable medical devices market will grow from USD 3.9 billion in 2014 to USD 5.83 billion in 2025, with diabetes, sleep disorders, obesity, and cardiovascular diseases representing the segments with highest growth.

mHealth

Adoption of mHealth solutions helps improve care delivery and reduce associated costs for healthcare organizations. Companies such as Google, Microsoft, and Apple are offering health apps that one can download for their respective devices. Individuals use these apps to manage their health by tracking various physiological factors—heart rate, physical activity, sleep, fertility, diabetes-related symptoms, and weight. Some of the pharmaceutical companies are involved in development of apps that are specifically designed for clinical trials. Companion apps are a common form of mobile clinical research software programs that are designed to be paired with a medication.

Mass adoption of mHealth devices is anticipated to spur demand for connected health and wellness devices over the forecast period.

Some of the examples of mobile applications being used in trials are:

- AstraZeneca utilizes mobile apps to gather information pertinent to adverse reactions that occur in clinical trials conducted for an experimental ovarian cancer combination therapy

- Stanford University enrolls more than 11,000 volunteers for cardiovascular trial in one day Through ResearchKit.

- A companion app with personalized tools was created by Bayer HealthCare to assist people on a specified drug. This app helps in monitoring treatment of multiple sclerosis

Remote Patient Monitoring

Remote patient monitoring enables pharmaceutical companies design patient-centric, trial protocols that enhance patient engagement in clinical trials by reducing the burden on the participants.

Following are some of the benefits associated with the use of remote patient monitoring devices:

- By collecting data remotely, sponsors of clinical trials can design trial protocols with fewer office visits and can increase the likelihood of enrollment in a trail

- The major concern for clinical trial sponsors is a patient’s recall validity. Remote monitoring helps in real-time analysis & provides feedback in a more comprehensive and consistent manner, hence reducing the recall burden

- Reduced potential errors that occurred during manual data entry

According to the statistics published by the National Institutes of Health’s records, as of 2015, minimum of 299 clinical trials were using wearables.

Below mentioned are some of the examples of the same:

- To track the physical activity of multiple sclerosis patients, Biogen uses wearable devices

- Cedars-Sinai utilizes a wearable device in a cancer trial to determine a patient’s ability for chemotherapy

- Bayer uses a wearable device for evaluation of the correlation between activity levels in patients with chronic thromboembolic pulmonary hypertension and pulmonary arterial hypertension

Telehealth

Rising demand for centralization of healthcare administration and enhanced safety & quality of care, is expected to drive the telehealth market. Furthermore, growing demand for mobile phones and the internet, with the rise in their adoption by patients in home care, is leading to fewer hospital visits, which is anticipated to boost the market. Telehealth capabilities of hospitals is being expanded to include patients in rural areas who are at high risk. This is anticipated to fuel further market growth in the coming years. Technological advancements in telecommunication and introduction of Affordable Care Act in the U.S. are some of the factors contributing to the increased adoption of telehealth services.

“E-commerce distribution is the largest contributor for the connected health and wellness devices market.”

Increase in the adoption of software and services such as health apps that are purchased majorly through e-commerce. It is more convenient for patients to purchase them from these platforms as compared to retail shops or distributors. Growth in the demand for purchasing online can be attributed to comfort, flexibility, and convenience.

The product details mentioned on websites make it convenient for customers to compare and analyze different options. Moreover, discounts offered by e-commerce websites benefit customers. Customers also tend to buy wellness products such as sports watches, activity trackers, sleep-quality monitors, and digital pedometers majorly through e-commerce.

Online retailers make it easy for customers to order as well as track the goods purchased by them. Moreover, the associated supply chain management integrates market intermediaries of the delivery channel, which reduces the overall costs. These factors boosting the adoption of e-commerce by consumers.

Recent Developments in Connected Health Market Space

The connected health and wellness devices market is monopolistic in nature and players are involved in the development of technologically advanced & user-friendly devices. Market leaders are involved in strategic alliances including merger & acquisition, partnership agreements and geographic expansion to gain a competitive advantage over the others. In addition, the presence of a competitive environment attributed to the existence of high R&D investments and efficient distributive agreements & contracts amongst industry players.

Omron Healthcare, Inc.

- In January 2018, Omron Healthcare, Inc. launched two new devices, Omron HeartGuide, which was the first oscillometric wrist BP monitor and Omron Blood Pressure Monitor + EKG, which was the first at home device capable to measure BP as well as EKG.

- In September 2017, the company launched OMRON Connect US App where consumers can analyze, track blood pressure and also can share with healthcare advisor.

- In July 2018, the company acquired 3A Health Care s.r.l in a probe to strengthen its portfolio in aerosol therapy.

- In May 2017, Omron Healthcare, Inc launched Omron EVOLV which is a wireless, portable upper arm BP monitor.

- In January 2017, the company announced to launch the first wireless TENS (Transcutaneous Electrical Nerve Stimulation) unit, designed to provide relief from acute and chronic pain.

GE Healthcare, Inc.

- In September 2017, GE Healthcare, Inc. launched the mammography device in a probe to help women to compress the pressure manually during the test

- In March 2017, the company launched CardioGraphe, the first cardiovascular CT system for cardiovascular imaging.

Fitbit Inc.

- In April 2018, Fitbit Inc. collaborated with Google in a probe to strengthen its portfolio in digital health.

- In September 2017, Fitbit Inc. launched Fitbit Care which is a wireless healthcare platform for better disease management.

Author Name:

Rucha Kamdi

Author Bio:

Rucha works in the capacity of team leader at Grand View Research and manages over 12 researchers and analyst. She has done her masters in business administration (marketing). Backed by bachelors degree in pharmaceutical sciences and over 8 years of industry experience, Rucha has a track record in market estimation, custom & syndicate research and consulting. Rucha has more than 100 research studies under her belt from biotechnology, pharmaceuticals, Healthcare IT industry, and medical devices, that includes infection control domain analysis for developed and emerging economies across the globe.