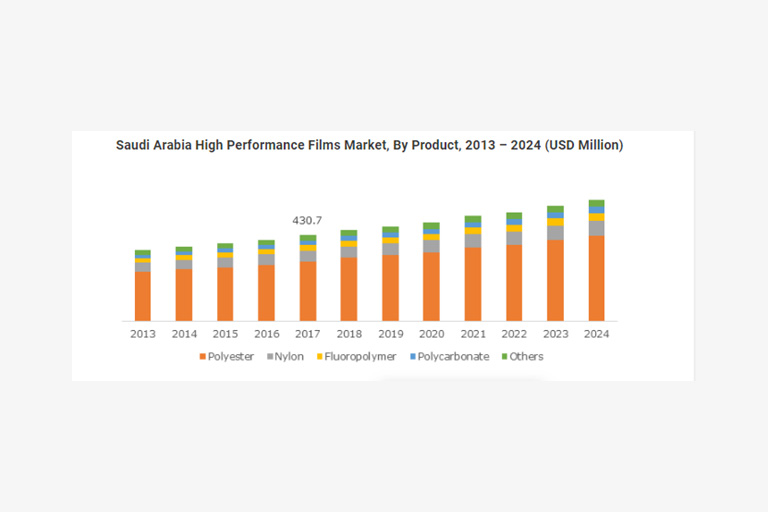

According to the Graphical Research new growth forecast report titled “Saudi Arabia High Performance Films Market Size By Product (Nylon, Polyester, Polycarbonate, Fluoropolymer), By Application (Safety & Security Films, Barrier Films, Microporous, Decorative), By End-Use (Personal Care Products, Packaging, Electrical & Electronics, Automobiles, Construction), 2018-2024”, estimated to exceed USD 600 million by 2024.

Growing construction activities triggered by rapid industrialization is expected to propel the high-performance films market size. Governments focus on development of key economic sectors including tourism and transport will further support the industry development. As per Saudi Arabia Ministry of Finance, 6% of total planned budget of USD 260 billion has been allotted for infrastructure and transportation sector in 2018. Strong demand in building and construction products such as exterior elements for LED lighting and windows & skylights to wall panels and roof domes will further promulgate the overall market growth.

Positive application outlook of HPF in automotive sector will drive the industry growth over the forecasted timeframe. Due to light weight of HPF films, they are able to provide optimal design and to make segments of front light bezels, internal focal points, entryway handles, and radiator flame broils. Government’s initiative to develop domestic automotive industry with several incentives being offered to global vehicle manufacturers is likely to proliferate demand for high performance films.

Stringent government regulations and guidelines pertaining to the usage of plastics in packaging industry is likely to affect the market growth. As per regulations imposed by Saudi standards, metrology and quality organization (SASO), plastic packaging materials must be made from approved oxo-biodegradable material. From December 2017 onwards, packaging material for consignment must gradually bear the biodegradable logo. This regulation is likely to downgrade the market growth for the forecasted timeframe.

Polyester material is anticipated to witness over 5.2% growth in terms of revenue up to 2024. Factors such as low moisture absorption, excellent mechanical, electrical and thermal properties likely to foster product demand. It is majorly used as films in several end user industries owing to its durability, strength, and resistivity towards chemicals, abrasion resistivity, hydrophobic nature, tensile properties, etc. Wide applicability in bottling and packaging industry will further influence the segment growth for the forecasted timeframe.

Barrier films market accounted for more than 200 USD million in 2017. High performance barrier films possess excellent flex crack, thermal resistivity and ultra-high oxygen barrier property. Other benefits including superior water and gas vapor barrier performance helps to protect products from degradation such as oxidation, moisture absorption, corrosion, rotting and drying. Increasing product demand across packaging industries for wide range of applications including high moisture barrier packaging for cereal, cookies & dry mixes and vacuum-controlled barrier bags for sausages and meat supporting this segment growth.

Eastman Chemical Company, Arabian Gulf Manufacturers Limited, and Taheel Integrated are among the major manufacturers of high-performance films. Other notable players in the market include Saudi Acrylic polymer company, Dow chemical company, 3M, Bayer material science and Bemis Company Inc. The Saudi Arabia industry share is highly fragmented owing to the presence of many global and domestic level players in the market. Product portfolio expansion, technological development and investments in R & D activities are among the key strategies adopted to gain significant competitive share by the major industry players.

Segments we cover:

Saudi Arabia High Performance Films Market, By Product

- Nylon

- Polyester

- Polycarbonate

- Fluoropolymer

Saudi Arabia High Performance Films Market, By Application

- Safety & Security Films

- Barrier Films

- Microporous

- Decorative

Saudi Arabia High Performance Films Market, By End-Use

- Personal Care Products

- Packaging

- Electrical & Electronics

- Automobiles

- Construction

Source : https://www.graphicalresearch.com/industry-insights/1186/saudi-arabia-high-performance-films-market