According to a new study published by Polaris Market Research the worldwide anti-drone market is anticipated to reach over USD 3,064 million by 2026. In 2017, the defense and military segment dominated the global market, in terms of revenue. North America is expected to be the leading contributor to the global market revenue during the forecast period.

The rising incidences of misuse of drones and growing terrorist activities primarily drive the growth of this market. Smugglers and traffickers are increasingly using drones for malicious and criminal activities, thereby increasing the demand of anti-drones. Other driving factors include technological advancement, and increasing investment in R&D.

There has been an emerging threat from drones to critical infrastructure. A high number of cases of drone overflights at nuclear and power stations have been registered. In 2014, after several cases of overflights of reactors, French authorities invested $1.1 million for detection, identification, and neutralization of small aerial drones.

For More Information @

https://www.polarismarketresearch.com/industry-analysis/anti-drone-market/request-for-sample

There has been a significant increase in spoofing and cyber-attacks. Spoofing is taking control of a drone by hacking the radio signal and sending commands to the aircraft from another control station. Valuable data can be stolen or deleted through cyber-attacks. Complaints registered against misuse of drones also include snooping, burglary, smuggling contraband into prisons, and mid-air near misses among others. Terrorists have started using drones to gather valuable intelligence on their enemies. All these factors have increased the adoption of anti-drone systems.

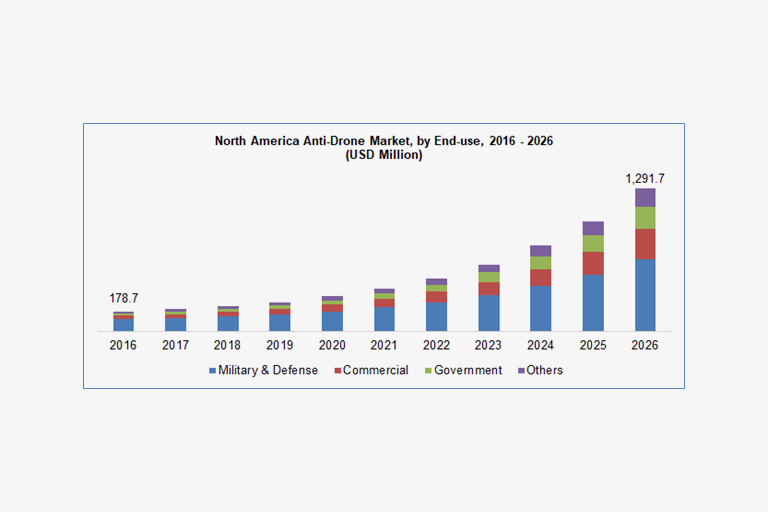

North America generated the highest revenue in the market in 2017, and is expected to lead the global market throughout the forecast period. The driving factors for anti-drone market in North America include increasing number of security breach incidents by unidentified drones and increasing terrorist activities. Recent incidences of riots & civil unrest have increased the demand for anti-drones in this region. North America spends high budgets for military expenditure and for research & development programs, which augment market growth.

The various end-users of anti-drones include defense and military, government, commercial, and others. In 2017, the defense and military sector accounted for the largest share in the global market, and is expected to maintain its lead during the forecast period. The demand for anti-drones in the military sector has increased owing to growing cases of smuggling, trespassing, and spying. Increasing need for border security, and threats from neighboring countries support the adoption of anti-drones.

The well-known companies profiled in the report include Saab AB, Thales Group, Raytheon Co., Lockheed Martin Corp. , Dedrone Inc, Droneshield Ltd., Northrop Grumman Corp., Theiss UAV Solutions, LLC, Blighter Surveillance Systems Ltd., Israel Aerospace Industries Ltd., among others. These companies launch new products and collaborate with other market leaders to innovate and launch new products to meet the increasing needs and requirements of consumers.