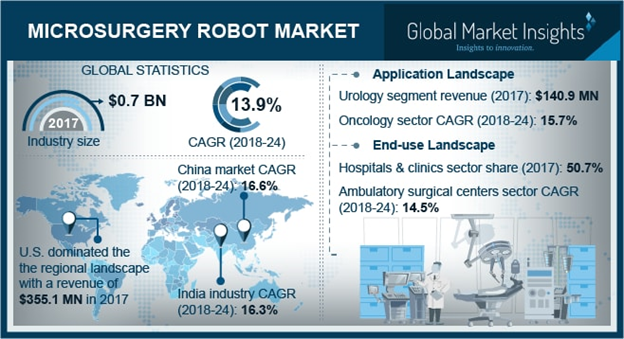

Microsurgery Robot Market size is set to exceed USD 1.7 billion by 2024; according to a new research report by Global Market Insights.

Increasing demand for minimally invasive surgical procedure will remarkably drive microsurgery robot market growth over the forecast period. Enhanced effectiveness, absence of post-operative complications and better patient outcomes are the major factors escalating demand for microsurgery robot. With employment of minimally invasive microsurgical robot, patients experience reduction in recovery time. Reduced hospital stays, and minimum scarring are other advantages associated with employment of microsurgery robot. Such factors will foster considerable business growth over the forthcoming period.

Increasing number of chronic diseases will spur the need for microsurgical robot in upcoming years. Chronic conditions such as cardiovascular disease, cancer, neurological disorders and high blood pressure escalate the need for surgical procedures. As robotic-assisted surgery offers wide array of benefits compared to non-robotic surgeries, its demand will increase. Microsurgery robots have huge applicability, including cardiovascular surgeries, neurological surgeries, and oncological surgeries. Use of advanced surgical robot for surgeries in hospitals and ambulatory surgical centers will in turn increase number of robotic-assisted surgical procedures, in foreseeable future. This will positively impact adoption of microsurgical robot, thereby driving industry growth during the forecast period.

Urology surgery segment held largest revenue, contributing to USD 140.9 million in 2017. Segmental growth is attributable to rise in number of prostatectomies worldwide, owing to rising incidence of prostate cancer. According to British Association of Urological Surgeons (BAUS), in 2014, 77% of patients suffering from prostate cancer underwent prostatectomies as primary treatment. Of these prostatectomies, around 50% procedures were performed with robotic assistance. Increasing incidences of prostate cancer and high adoption of microsurgical robots in oncology application will favor segmental growth over forecast timeframe.

Hospitals segment was the largest segment in 2017 with revenue size of USD 346.4 million. Increasing number of surgical procedures owing to rise in number of chronic conditions will lead to segmental growth. Various reimbursement policies in developed economies for treatment purposes and growing healthcare expenditure in developing economies will favor segmental growth during the forecast period.

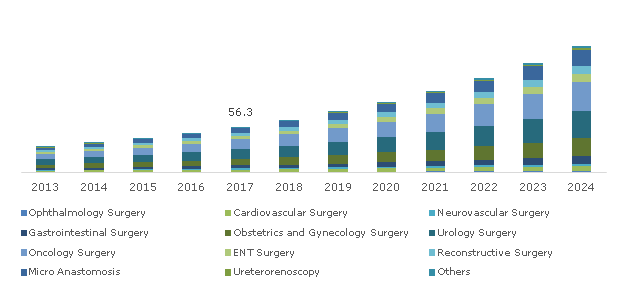

Japan Microsurgery Robot Market Size, By Application, 2013 – 2024, (USD Million)

U.S. dominated North America microsurgery robot market in 2017 with revenue size of USD 355.1 million, owing to escalated demand of minimally invasive robot-assisted surgical procedures. Huge demand is attributable to advantages associated with microsurgical robot. Robot-assisted surgical procedures offer advantages such as reduction in hospital stay, less pain and low chances of infection. Moreover, high disposable income, better patient affordability and favorable reimbursement policies will further lead to business growth in the future.

China microsurgery robot market will grow at 16.6% owing to emerging cases of chronic diseases coupled with high demand for minimally invasive surgical procedures. According to World Health Organization (WHO), in 2015, more than 110 million adults in China suffered from chronic diseases such as cardiovascular diseases, diabetes, cancer. High pervasiveness of chronic diseases is credited to behavioral risk factors like smoking tobacco, drinking alcohol, unhealthy and poor diet. Growing incidence of chronic diseases will escalate demand for microsurgical robot, thereby propelling industry growth.

Some of the prominent players involved in microsurgery robot market are Auris Health, Intuitive Surgical, Mazor Robotics, Medrobotics, Medtronic, Smith & Nephew, Stryker, Titan medical, Transenterix and Zimmer Biomet. These firms are adopting strategies initiatives like mergers and acquisitions, geographical expansion and new product launch to reap benefits in microsurgery robot market. For instance, in May 2018, Intuitive Surgical announced its independent operations in India. This will expand the company’s geographic outreach and attract large customer base in emerging markets for long-term growth in future.

Source: https://www.gminsights.com/pressrelease/microsurgery-robot-market