WEX Inc.

signed a definitive agreement to acquire one of the leading integrated software-as-a-service (SaaS) technologies and services provider, Benaissance. The transaction is valued at $80 million and is expected to close in the fourth quarter of 2015, subject to regulatory approvals.

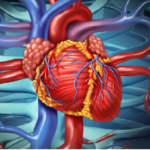

The deal complements WEX’s efforts to enhance healthcare services by providing an expanded and differentiated payments solution. As a result, the company expects the acquisition to help it occupy a greater market share and boost customer loyalty and wallet share going ahead. Financially, the deal is expected to be accretive to the 2016 results of WEX, excluding one-time integration costs.

Benaissance, through its SaaS solutions has revolutionized premium billing and payment acceptance practices. The entity has already built a successful relationship with WEX’s Evolution1 platform over the past decade. On culmination of the deal, Benaissance will be integrated with the same.

The acquisition is expected to boost WEX’s offerings in the healthcare payment services space, which is indeed a high-growth area. In turn, this should boost the top line and be accretive to earnings.

WEX also remains focused on transforming its business into a multi-channel corporate payment solutions provider. Last month, the company purchased the remaining 49% interest in UNIK S.A. This is in addition to the 51% stake in UNIK that the insurer had acquired earlier in 2012. With this, WEX now has a 100% ownership in the entity.